People engaged in economic activities are all curious about where the economy is heading.

Since the era of liquidity unleashed by the post-COVID monetary policies has resulted in inflation, it’s making life tough for the common folks.

While I can’t speak for the local conditions in the U.S., it seems like every country except the U.S. is paying the price for this liquidity surge.

With the dollar being the anchor currency and the U.S. being its reference point, the global economy revolves around the U.S., affecting the economic activities of other countries according to the periodic data released by the Fed.

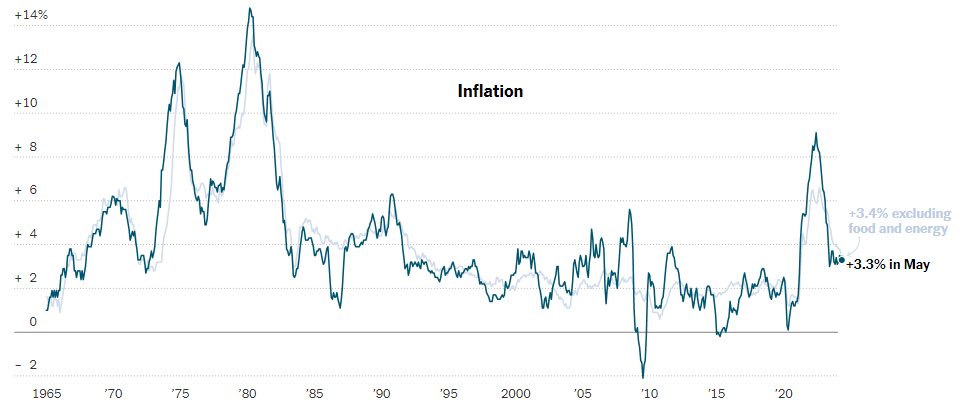

On June 12th, in U.S. local time, it was announced that the Consumer Price Index (CPI) for May rose by 3.3% compared to the same month last year.

According to the U.S. Department of Labor, the May CPI in the U.S. increased by 3.3% from the same period last year, falling below market experts’ expectations (3.4%) as compiled by Dow Jones and lower than the previous month (3.4%).

These figures being relayed through the announcements could be interpreted as a sign of inflation easing, possibly leading to speculation about the direction of the interest rate cuts by the U.S. Federal Reserve that trouble us.

However, on the flip side, if wage increases lag behind the rise in prices, consumption could shrink.

While I can’t confirm if this is the case for every country, in my country, there’s a phenomenon where the inflation rate surpasses the wage growth, resulting in a decrease in real wages, which could create an illusion of lowering prices through reduced consumption.

Will inflation really improve? Or is the era of deflation approaching?

Year-over-year change in the Consumer Price Index, Source: Bureau of Labor Statistics