In my last post, I briefly touched on why Bitcoin has value.

This time, I want to write about something called halving, which is one of the reasons why Bitcoin’s value keeps rising.

If you’ve studied chemistry or science, you might know that the term “half-life” refers to the time it takes for half of a radioactive isotope to decay in nature.

For example, the half-life of element A is the time it takes for its quantity to reduce by half.

Bitcoin’s halving is similar to this concept.

Before we dive into halving, we need to understand how Bitcoin is obtained.

Simply put, Bitcoin is a reward for solving certain computational problems.

These computations aren’t something an average person can do; they require sophisticated computing machines to solve.

Once the problem is solved, a certain amount of Bitcoin is awarded as a reward.

Halving refers to the point when this reward is cut in half.

For instance, if solving problem B for a month yields 1 Bitcoin, after halving, solving the same problem B for a month would yield only 0.5 Bitcoin.

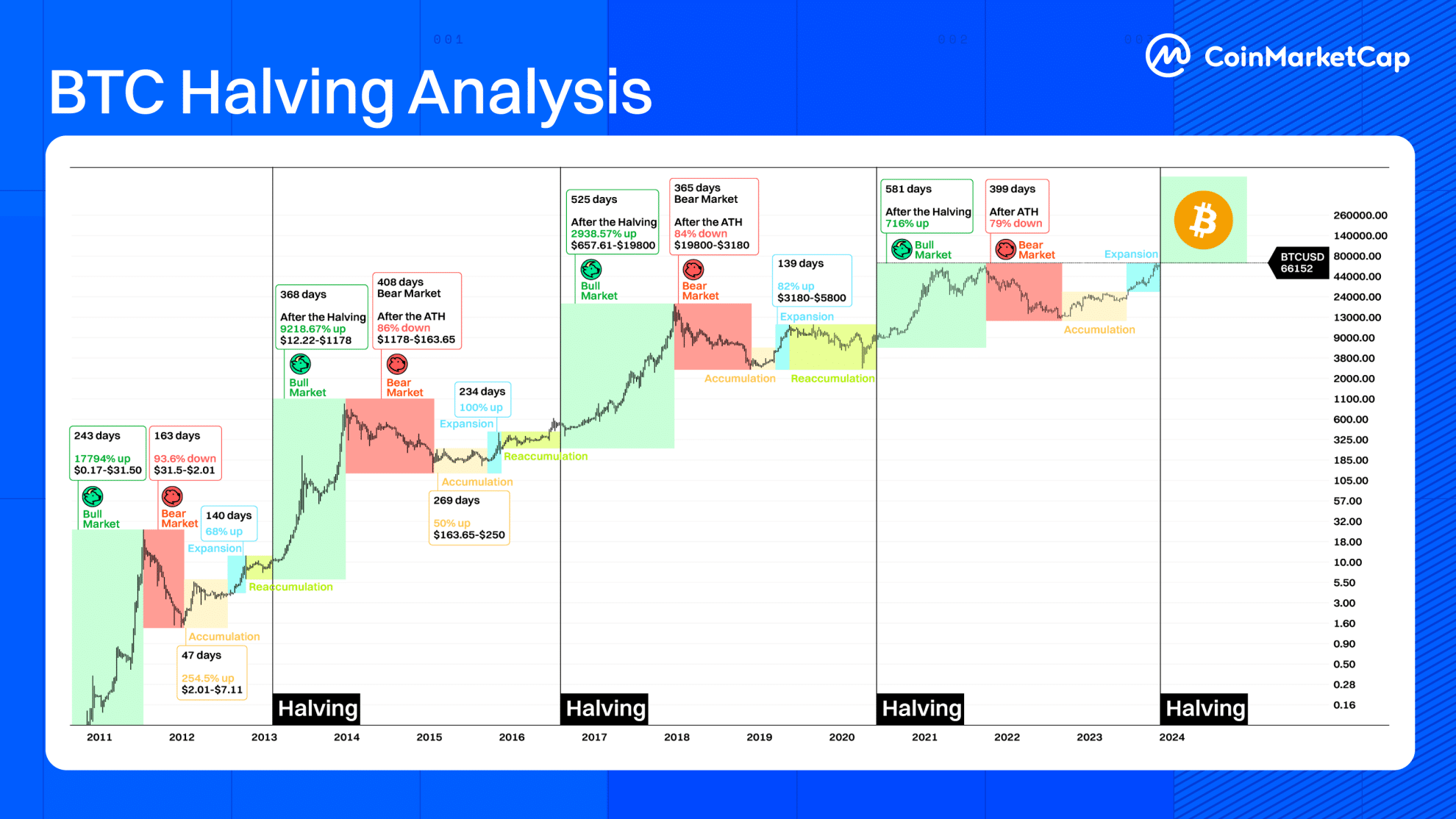

Since Bitcoin’s creation in 2009, halving has occurred every four years: in 2012, 2016, 2020, and the next one is in 2024.

The common trend with each halving is that Bitcoin’s value tends to increase several times to even tens of times after the halving.

The most recent halving in 2024 hasn’t yet shown this cycle,

but people believe, as in the past, that Bitcoin’s value will rise following the halving, leading them to invest boldly.

The belief that Bitcoin’s value increases after halving is also supported by the fact that its total supply is fixed at 21 million.

As more halvings occur, the number of Bitcoins obtained as rewards decreases, and once 21 million Bitcoins are mined, no more can be acquired. The system is designed this way.

With this characteristic of being a limited asset, the influential entities I mentioned in my previous post use this justification to drive the value higher.

Thus, Bitcoin is in the process of catching up to the massive value established by other assets in a very short time.

This post is getting lengthy, so I’ll continue the discussion in the next one.