Growing up, Nike was undoubtedly the top athletic shoe brand in the United States.

Their lineup boasted iconic models such as the Air Force, Air Jordan, Dunk series, Cortez, and Air Max—names that resonate with nearly everyone.

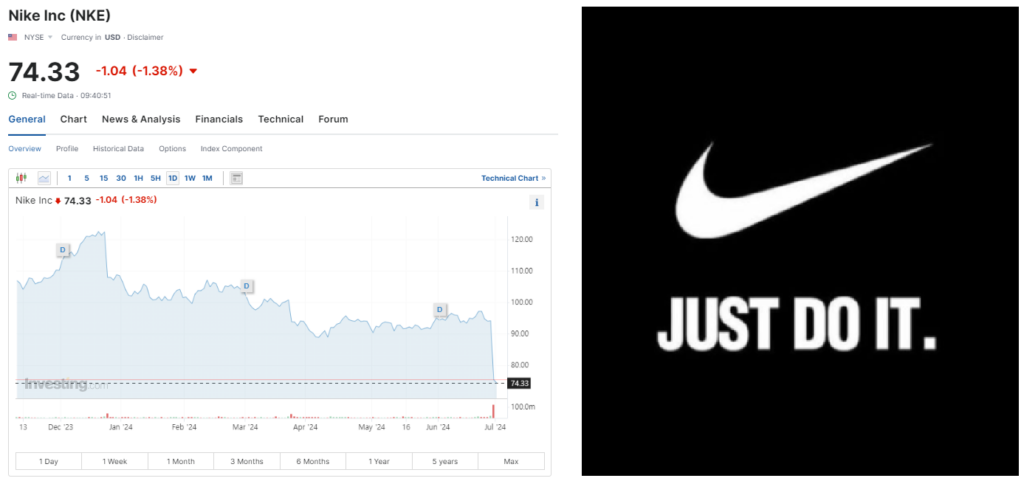

Recently, a surprising turn of events hit Nike, the undisputed leader in sportswear. On June 28th, Nike’s stock price plummeted by about 20%.

Since hitting its peak at the end of 2021, the stock has been on a steady decline, a peak likely influenced by the liquidity surge during the COVID-19 era. This is because Nike, a massive corporation, historically hasn’t seen dramatic sales fluctuations.

However, last week’s plunge is different. Nike reported more than a 2% drop in sales compared to last year, and the future outlook seems bleak.

For a behemoth with a market cap exceeding $110 billion to lose over 20% of its stock value, there must be a reason. It’s unlikely that this is merely due to a dim sales forecast or the brand becoming a so-called “icon without innovation” as some say.

Current news articles attribute the decline to weak performance and poor forecasts, but as always,

the true reason behind such a dramatic stock drop will likely surface over time.

It’s hard to believe that a major sportswear giant like Nike, even if recycling past glories without much innovation, could see a 20% plunge overnight.

As the market opens on the first day of July, it will be crucial to watch whether this steep decline leads to a rebound or if there are yet undiscovered reasons behind it.

In the meantime, I find myself hoping this situation leads to more discounts on Nike products. I certainly plan to take advantage and buy more.

This post may seem a bit scattered and isn’t meant to serve any particular purpose. It’s just a record of my thoughts on this issue.

Source: Left, Nike Inc Stock Chart (Daily), Investing.com / Right, Nike Logo, kr.pinterest.com/pin/60446819985660800